Form ITD 3414. Affidavit of Inheritance

Form ITD 3414 is used in Idaho to establish inheritance when a decedent passes away without a will or with an incomplete or invalid will. The main purpose of this form is to provide a legal document that verifies the rightful heirs of the decedent's estate.

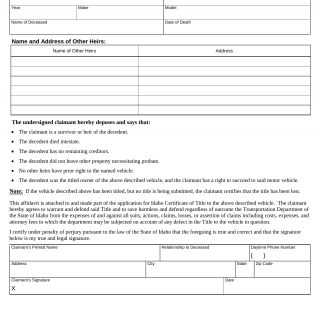

The form consists of sections where the affiant provides information about themselves, including their name, address, contact details, and relationship to the decedent. It also requires them to provide details about the decedent's assets and liabilities and lists the names and addresses of other potential heirs.

When filling out the form, it is important to accurately provide all required information and ensure that the affidavit reflects the true and complete inheritance situation. The affiant should carefully review the instructions on the form and consult with an attorney or legal professional if needed to ensure compliance with applicable laws.

An example application scenario would be when a person passes away without leaving a valid will, and their estate needs to be distributed among their heirs. By completing this form and submitting it to the appropriate authority, the affiant can establish the legal inheritance rights of the decedent's beneficiaries.

Related forms: An alternative form closely related to this affidavit is Form ITD 3090 - Affidavit for Collection of Personal Property. This form is used when the decedent's assets consist solely of personal property, such as bank accounts, vehicles, or personal belongings. The difference is that Form ITD 3414 specifically focuses on establishing inheritance rights, while Form ITD 3090 is used for the collection of personal property within the estate.