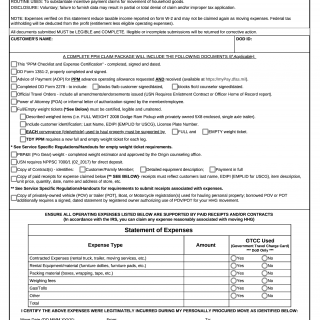

DD Form 3166. Personally Procured Move (PPM) Checklist and Expense Certification

The DD Form 3166, or Personally Procured Move (PPM) Checklist and Expense Certification, is a significant document designed to assist individuals in obtaining reimbursement for the expenses incurred during a PPM. PPM, also known as a "do-it-yourself" or "personally arranged" move, occurs when individuals relocate their household belongings due to job changes, military service, or other qualifying reasons. This form plays a pivotal role in streamlining the reimbursement process and ensuring that the move is adequately documented.

Purpose of DD FORM 3166:

The DD Form 3166 serves several critical purposes, making it an essential part of the PPM process:

-

Expense Reimbursement: The primary purpose of this form is to enable individuals to claim reimbursement for the expenses they have legitimately incurred while moving their household goods. These expenses can encompass a wide range of costs associated with the move.

-

Financial Support: The completion and submission of DD Form 3166 help individuals recover the money they spent on their move, thus providing financial support and reducing the out-of-pocket expenses associated with relocating.

-

Tax Implications: Properly filling out and submitting this form can impact taxable income. It's important for individuals to understand how their expenses affect their tax obligations, as some expenses may be deductible or affect their tax returns.

-

Documentation: The form acts as a crucial piece of documentation to substantiate the legitimacy of expenses incurred during the PPM. It provides a detailed record of expenses, which may be audited or reviewed to ensure compliance with regulations.

Cases and Examples:

-

Military Personnel: Military members often use DD Form 3166 when they relocate due to Permanent Change of Station (PCS) orders. They can claim expenses related to moving their household goods, such as truck rental fees, packing materials, transportation costs, and more.

-

Government Employees: Government employees who are authorized to move as part of their employment may use this form to claim expenses incurred during a job-related move, such as transportation costs, lodging, and temporary storage fees.

-

Civilian Job Changes: Individuals who change jobs and need to relocate for their new employment may also qualify for PPM and use this form to claim eligible expenses associated with their move.

-

Tax Considerations: Suppose an individual relocates and incurs expenses like packing supplies, transportation, and temporary lodging. Properly documenting these expenses on DD Form 3166 can lead to tax benefits, potentially reducing taxable income.

-

Receipts and Documentation: It's crucial to keep receipts and detailed records of expenses. For example, if someone rented a moving truck, they should keep the rental contract and receipts for fuel and other associated costs to support their claim.

In summary, DD Form 3166 is a versatile tool that helps individuals recover expenses, manage tax implications, and document their PPM effectively. Whether it's military personnel, government employees, or civilians undergoing job changes, this form plays a vital role in ensuring that individuals are fairly reimbursed for the expenses incurred during their moves.