Credit Reference Letter

A credit reference letter is an essential document typically issued by a financial institution or creditor to confirm an individual's creditworthiness and financial reliability. Its main purpose is to provide assurance to potential lenders, creditors, or business partners regarding the individual's financial standing.

The letter generally consists of the following parts:

- Salutation: Begin the letter with a professional greeting, addressing the recipient appropriately.

- Introduction: In the opening paragraph, establish the relationship between the financial institution or creditor and the individual. Mention any details regarding their account, credit history, or financial transactions.

- Creditworthiness: This section focuses on the individual's creditworthiness, highlighting their ability to manage credit responsibly. Discuss their payment history, including timely payments, adherence to credit terms, and any outstanding debts. Include specific details about the length and type of credit relationship with the individual.

- Financial Reliability: Address the individual's financial reliability, providing insights into their overall financial standing. Discuss any information related to their financial assets, income stability, stability of employment, or business operations. Highlight positive aspects that contribute to their financial reliability.

- Conclusion and Recommendation: Conclude the letter by summarizing your overall impression of the individual's creditworthiness and financial reliability. Offer a positive recommendation based on your assessment. Provide your contact information should the recipient have any further questions or require additional information.

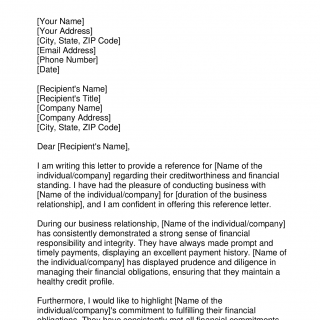

Sample of Credit Reference Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing this letter to provide a reference for [Name of the individual/company] regarding their creditworthiness and financial standing. I have had the pleasure of conducting business with [Name of the individual/company] for [duration of the business relationship], and I am confident in offering this reference letter.

During our business relationship, [Name of the individual/company] has consistently demonstrated a strong sense of financial responsibility and integrity. They have always made prompt and timely payments, displaying an excellent payment history. [Name of the individual/company] has displayed prudence and diligence in managing their financial obligations, ensuring that they maintain a healthy credit profile.

Furthermore, I would like to highlight [Name of the individual/company]'s commitment to fulfilling their financial obligations. They have consistently met all financial commitments, including loan payments, invoices, and any other financial obligations. Their financial accountability is a testament to their reliability and trustworthiness as a business entity.

I believe [Name of the individual/company] has a strong credit history and is a reliable candidate for any credit or financial opportunities. I have no hesitation in recommending them for any financial endeavors they may pursue, including credit applications, loans, or business partnerships.

Should you require any additional information or documentation, please feel free to contact me at [Your Phone Number] or [Your Email Address]. I am more than happy to provide any further details that may assist you in evaluating [Name of the individual/company]'s creditworthiness.

Thank you for considering this reference letter, and I am confident that [Name of the individual/company] will continue to demonstrate excellence in financial matters. I recommend them without reservation.

Yours sincerely,

[Your Name and Title]

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

When writing a credit reference letter, it is important to be honest, accurate, and objective. Stick to the facts and avoid exaggeration or making false statements about the individual's credit history or financial standing. Adhere to any specific guidelines or instructions provided by the recipient, such as length limitations or specific information they require.

Key information required when writing the letter includes your name, position, name of the financial institution or creditor, contact information, and the date of writing. Use professional language and format the letter appropriately to enhance its credibility.

No additional documents are typically required or attached to a credit reference letter. However, if there are any relevant supporting documents, such as credit reports or financial statements, they can be mentioned in the letter or attached separately upon request.

Strengths of a credit reference letter include providing an independent assessment of an individual's creditworthiness and financial reliability. It helps in making informed decisions regarding credit approvals, loan applications, or financial transactions by establishing trust and verifying the individual's financial standing.

One potential weakness is that the letter's content is based on the perspective and experience of the writer. Different creditors or financial institutions may have varying criteria or assessments, which can impact the perception of the individual's creditworthiness.

Alternative forms to a credit reference letter could include credit reports, bank references, or trade references. These forms provide more formal and structured assessments of an individual's credit history, financial transactions, or business relationships.

The credit reference letter significantly impacts the future of the individual by influencing potential lenders, creditors, or business partners. A strong reference can enhance their financial reputation and increase their chances of obtaining credit or favorable financial terms.

The letter is typically submitted directly to the recipient, such as a potential lender, creditor, or business partner, through mail or email, as specified in the application or transaction process. The letter should be saved and stored by both the writer and the recipient for future reference or verification.