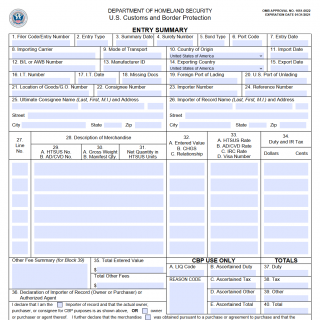

CBP Form 7501: Entry Summary form

The CBP Form 7501: Entry Summary form is an important document used by the U.S. Customs and Border Protection (CBP) to collect detailed information about goods imported into the United States. The form is filled out by the importer of goods and sent to the CBP in order to obtain an entry summary number that is used to track goods through the customs process.

The form consists of several parts that must be completed in order to properly identify the goods being imported. This includes information about the goods being imported, the importer and exporter, the intended market for the goods, the applicable tariff classifications, the value of the goods, and other important data about the goods.

One of the most important fields on the form is the 10-digit Harmonized Tariff System (HTS) number. This number is used to determine the type of goods being imported and the applicable duties and fees that must be paid. Other important fields include the Customs Value, Estimated Duty, and Country of Origin.

The CBP Form 7501: Entry Summary should be compiled when goods are being imported into the United States. The importer of goods will be the party to the document and is responsible for filling out all the required fields. It is important to properly identify the goods being imported, as incorrect information could result in paying incorrect duties and/or fees.

When compiling the CBP Form 7501: Entry Summary, it is important to consider its various features. The form is designed to provide the CBP with accurate and detailed information about the goods being imported and the parties involved. It is also important to provide an accurate estimate of the value of the goods being imported, as this will determine the applicable duties and fees.

The advantages of the CBP Form 7501: Entry Summary are clear. It provides an accurate and detailed picture of the goods being imported, allowing the CBP to make better informed decisions about the goods in question. It also allows importers to accurately track their goods as they pass through the CBP's customs process.

There can be some problems when filling out the CBP Form 7501: Entry Summary, including incorrect information being provided or missing data. Inaccurate information or missing details can result in incorrect calculations or the incorrect application of duties and fees to the goods being imported.

The CBP Form 7501: Entry Summary is related to several other forms and documents. For example, the CBP Form 3461 is used to provide additional information about the goods being imported or to correct information on the CBP Form 7501. Additionally, the CBP Form 3299 is used to declare goods for import into the United States.

Alternative forms to the CBP Form 7501: Entry Summary include the Automated Clearinghouse Nonresident Importer (ACH-NRI) and the Electronic Data Interchange Nonresident Importer (EDI-NRI) forms. These forms are primarily used by nonresident importers and require different information and procedures than the CBP Form 7501.

The CBP Form 7501: Entry Summary is submitted electronically, using the ACE Secure Data Portal, and all copies are securely stored in the CBP's official record-keeping systems.