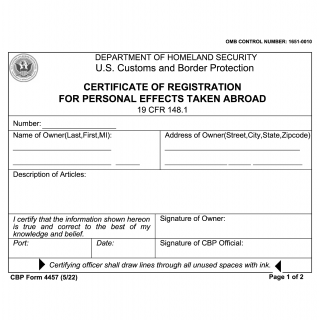

CBP Form 4457. Certificate of Registration for Personal Effects Taken Abroad

CBP Form 4457, also known as the Certificate of Registration for Personal Effects Taken Abroad, is a form used by travelers who want to register personal effects with U.S. Customs and Border Protection (CBP) before leaving the country. The main purpose of the form is to provide proof of ownership for personal effects that are taken abroad, allowing the traveler to bring them back into the United States duty-free.

CBP Form 4457 consists of one page and requires the traveler to provide personal information, such as their name and address, as well as information about the personal effects they are taking abroad. The form also requires the traveler to provide a description and value of each item, as well as any applicable serial numbers or other identifying information.

To complete the form, travelers will need to provide a valid form of identification, such as a passport or driver's license, and any applicable receipts or other documents that prove ownership of the personal effects being registered.

Examples of practice and use cases for CBP Form 4457 include travelers who are taking expensive or valuable personal effects abroad, such as cameras, laptops, or jewelry. The form is important to ensure that the traveler can prove ownership of these items and avoid paying customs duties when bringing them back into the United States.

Strengths of CBP Form 4457 include its simplicity and ease of use. Weaknesses may include the need for travelers to provide additional documentation to prove ownership of personal effects, which can be time-consuming and inconvenient. Opportunities may include the ability to streamline the registration process and reduce the amount of documentation required. Threats may include changes in customs laws and regulations that could impact the use of the form.

Alternative forms or analogues to CBP Form 4457 include the CBP Form 4455, which is used for registering personal effects taken abroad by military personnel, and the CBP Form 3299, which is used for declaring imported articles that are subject to duty. The main differences between these forms are the specific use case and the information required.

Once completed, CBP Form 4457 is submitted to CBP for review and approval. The form is stored electronically and is subject to verification by CBP. The form affects the future of the participants by allowing them to legally bring personal effects back into the United States duty-free.