Form FMS 108. Vehicle Registration Withholding Credits Certification - Virginia

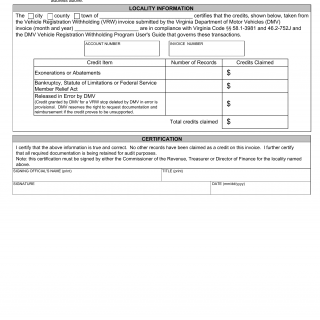

Form FMS 108. Vehicle Registration Withholding Credits Certification is used by localities in Virginia to certify any credits taken on the monthly invoice for Vehicle Registration Withholding fees. This form enables localities to report and validate credits that may offset vehicle registration fees collected from residents or businesses.

The parties involved in this form are the localities in Virginia, such as cities or counties, and the Virginia Department of Motor Vehicles (DMV). The form consists of sections where localities can provide information about the credits they are certifying and the reasons for granting those credits.

Important fields in this form include the name of the locality, contact information, and details about the credits being certified. The form may also require explanations for the credits, supporting documentation, and the period for which the credits are applicable.

An example scenario where this form would be used is when a city government decides to grant credits to a business for its fleet of vehicles due to specific circumstances, such as promoting eco-friendly vehicles or supporting local businesses. By using this form, the city can formally certify the credits to the DMV for proper accounting and billing.

When completing this form, localities must ensure accuracy and clarity in providing information about the credits. Any supporting documents must be attached to validate the credits claimed.

No specific related or alternative forms are mentioned for this purpose, indicating that this form is likely the designated one for certifying vehicle registration withholding credits in Virginia localities.