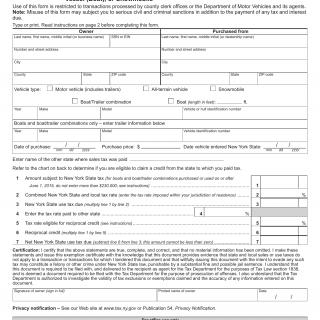

NYS DMV Form DTF-804. Statement of Transaction – Claim for Credit of Sales Tax Paid to Another State For Motor Vehicle, Trailer, All Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile (at NY State Department of Tax & Finance)

NYS DMV Form DTF-804 is used when a New York resident purchases a vehicle out-of-state, registers the vehicle in New York State, and applies for credit for the sales tax paid in the other state. This form enables eligible individuals to claim a credit for the sales tax amount paid in another state, reducing the sales tax liability in New York.

The form typically includes sections where the individual can provide information about the out-of-state purchase, details of the vehicle, proof of payment of sales tax in the other state, and any supporting documentation required by the New York State Department of Tax & Finance.

Important fields on this form may include the individual's contact information, details of the out-of-state purchase, sales tax payment information, and any additional information needed to process the claim for credit. Accurate completion of these fields ensures a proper assessment of the credit and helps individuals reduce their sales tax liability appropriately.

Application Example: New York residents use Form DTF-804 when they purchase a vehicle out-of-state and want to claim a credit for the sales tax paid in the other state. By providing the necessary information, proof of payment, and supporting documentation, individuals can apply for a credit and reduce their sales tax liability in New York.

Related Forms: Depending on specific circumstances or requirements, additional forms related to out-of-state vehicle purchases, registration, and sales tax credits may exist. It is recommended to consult the New York State Department of Motor Vehicles and the Department of Tax & Finance or relevant authorities for the most accurate and up-to-date information.