Form HSMV 96440. IRP/IFTA Power of Attorney and Instructions - Florida

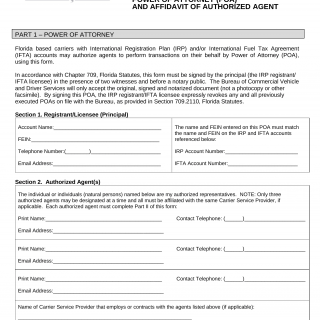

Form HSMV 96440 is used in Florida for granting power of attorney and providing instructions related to the International Registration Plan (IRP) and International Fuel Tax Agreement (IFTA). This form is utilized by motor carriers or authorized representatives to appoint someone else to act on their behalf for IRP/IFTA matters.

The form consists of sections where the motor carrier or authorized representative can provide their information, such as name, address, and contact details. It includes fields to specify the appointed power of attorney, provide instructions, and authorize the designated individual to handle IRP/IFTA-related transactions.

Important fields in this form include the motor carrier's or authorized representative's information, the appointment of a power of attorney, specific instructions or limitations, and the authorization signature. It is crucial for the form to be accurately filled out with complete information and for all parties involved to understand the scope and responsibilities of the appointed power of attorney.

Application Example: A motor carrier company in Florida may use this form to appoint a representative to handle their IRP/IFTA-related transactions, such as vehicle registration renewals or fuel tax reporting. The form should be completed with accurate information and clear instructions for the appointed power of attorney.

Related Forms: There may not be direct alternatives or analogues to Form HSMV 96440, as it specifically serves the purpose of granting power of attorney for IRP/IFTA matters in Florida. However, there may be other forms related to power of attorney or motor carrier registrations within the Department of Highway Safety and Motor Vehicles.