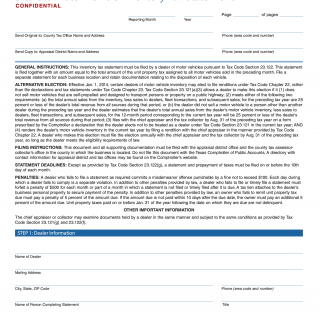

Form 50-246. Dealer's Motor Vehicle Inventory Tax Statement

The Form 50-246, Dealer's Motor Vehicle Inventory Tax Statement, is a document used in Texas to report the inventory of motor vehicles held for sale by licensed motor vehicle dealers. The form consists of several parts that must be completed with accurate information about the dealer's inventory, such as the make, model, year, and vehicle identification number (VIN) of each vehicle.

The primary purpose of this form is to determine the amount of inventory tax owed by the dealer to the county or municipality where the inventory is located. The tax is calculated based on the total value of the inventory as of January 1st of each year.

Important fields on the form include the dealer's name, address, taxpayer identification number, and the number of vehicles in inventory. Additional documentation required to complete the form may include copies of titles, invoices, and purchase agreements.

Examples of when the form is necessary are when a dealer obtains a license to sell motor vehicles or when there are changes in inventory during the year. Failure to file the form or pay the inventory tax on time can result in penalties and interest.

Strengths of the form include its clear instructions and straightforward format. A weakness may be the potential for errors if accurate records are not maintained. Opportunities for improvement could include implementing an online filing system to streamline the process. A threat could be increased competition from out-of-state dealers who do not have to pay inventory tax.

Alternative forms or analogues of the Form 50-246 may include similar inventory tax statements required by other states for motor vehicle dealers. The difference between them can vary depending on state laws and regulations.

Once completed, the form should be submitted to the county or municipality where the inventory is located. It is important for dealers to keep a copy of the form and all supporting documentation for their records.

Overall, the Form 50-246 plays an important role in ensuring that motor vehicle dealers comply with inventory tax requirements and contribute to their local communities.