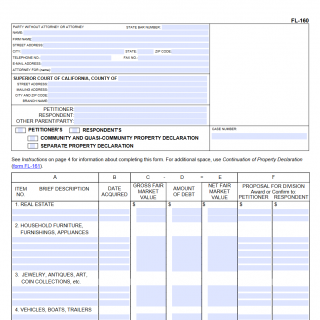

Form FL-160 Property Declaration

Form FL-160 Property Declaration is a legal document used in California family law cases. Its main purpose is to provide a declaration of all property and debts held by each party in a divorce or legal separation case. This form is typically used in conjunction with Form FL-142 Schedule of Assets and Debts.

The form consists of several parts, including a heading that identifies the parties and the case number, a section for the declarant to list all personal property, real property, and debts, and a signature line for the declarant to sign under penalty of perjury.

Important fields on the form include the declarant's name, address, and contact information, as well as detailed information about each item of property or debt listed, such as the fair market value, loan balance, and whether the item is community or separate property.

Examples of use for Form FL-160 Property Declaration include providing a complete list of all property and debts held by each party in a divorce or legal separation case, as well as providing evidence to support a claim for property division or spousal support.

Parties involved in the use of Form FL-160 Property Declaration include both parties in a divorce or legal separation case, as well as their attorneys (if applicable).

It is important to consider the accuracy and completeness of the information provided on Form FL-160 Property Declaration, as any false statements made under penalty of perjury could result in legal consequences.

Benefits of using Form FL-160 Property Declaration include providing a clear and complete list of all property and debts held by each party in a divorce or legal separation case. It can also help to ensure that all property is properly divided between the parties and can potentially prevent future disputes.

Risks of using Form FL-160 Property Declaration include the possibility of making false statements, which could result in legal consequences. It is important to ensure that all information provided is accurate and truthful.

Related and alternative forms to Form FL-160 Property Declaration include Form FL-150 Income and Expense Declaration, which is used to provide a detailed accounting of each party's income and expenses, and Form FL-142 Schedule of Assets and Debts, which is used to provide a detailed list of all assets and debts held by each party.

Analogues to Form FL-160 Property Declaration include similar legal documents used in other states, such as property settlement statements or asset and debt declarations.

Differences between Form FL-160 Property Declaration and other legal documents include the specific formatting and requirements for the declaration under California family law.

The use of Form FL-160 Property Declaration can influence the future of the participants in a case by providing evidence that supports their position and can potentially affect the outcome of the case.

The completed form should be submitted to the court and served on all parties in the case. It is important to keep a copy of the completed form for personal records.