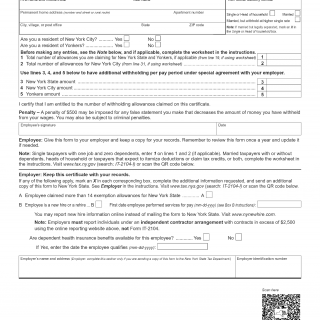

Form IT-2104. Employee’s Withholding Allowance Certificate

The Employee’s Withholding Allowance Certificate, also known as Form IT-2104, is a document that is used by employees in the state of New York to specify how much tax should be withheld from their paychecks. The main purpose of this form is for employers to determine the correct amount of taxes to withhold from their employees' wages.

This form consists of several parts, including personal information, exemptions and deductions claimed, additional withholding amounts, and signature lines. It is important to fill out all necessary fields correctly to ensure accurate withholding.

Some important fields on the form include the employee's name, Social Security number, filing status, allowances claimed, and any additional withholding amounts. When filling out the form, employees should have their most recent W-4 form or tax return on hand to help them accurately calculate their withholding.

One document that may need to be attached when submitting Form IT-2104 is a copy of the employee's federal W-4 form. This can help ensure that the employee's federal and state withholding amounts are consistent.

Examples of when someone might need to fill out Form IT-2104 include starting a new job, changing their marital status, or adjusting their desired withholding amount. Employers may also request that employees update their withholding by filling out this form periodically.

Strengths of Form IT-2104 include its ability to ensure accurate tax withholding and its ease of use. Weaknesses may include confusion or errors when filling out the form if the employee is not familiar with tax terminology.

Alternative forms to Form IT-2104 include the federal W-4 form, which is used for federal tax withholding, and other state-specific withholding forms for states outside of New York. These forms may differ in their specific requirements and fields.

Submitting Form IT-2104 is typically done through the employee's employer, who will then submit it to the appropriate tax agency. The form is stored by the employer for their records.

Overall, Form IT-2104 is an important document for employees and employers in New York to ensure accurate tax withholding. It can help avoid any surprises at tax time and ensure that taxes are being paid correctly throughout the year.