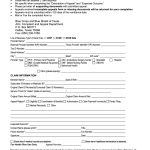

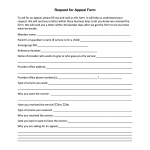

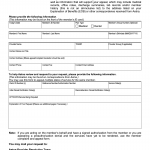

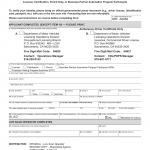

Out-of-network Appeal Letter

An out-of-network appeal letter is a formal written request made by a patient or their healthcare provider to an insurance company. The purpose of the letter is to challenge a denial or reduction of coverage for medical services received from a healthcare provider who is not part of the insurance company's established network.