Form FT 226. Fuels Tax Refund Application for Fuel Used in Diesel Vehicles - Virginia

Form FT 226. Fuels Tax Refund Application for Fuel Used in Diesel Vehicles is used to apply for a refund of the Virginia fuels tax on diesel fuel used in specific vehicles. The primary purpose of this form is to allow eligible vehicle owners to claim a refund for the fuels tax paid on diesel fuel used in certain vehicles.

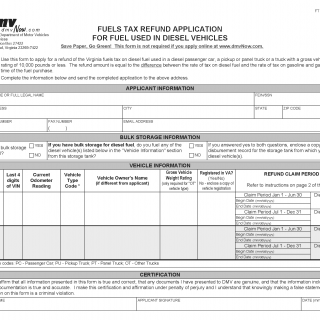

The parties involved in this form are the vehicle owners applying for the refund and the Virginia Department of Motor Vehicles (DMV). The form consists of sections where the vehicle owner provides information about the vehicle, fuel usage, and the amount of fuels tax paid.

Important fields in this form include the vehicle owner's name, contact information, vehicle details (e.g., make, model, year), and fuel usage specifics (e.g., gallons of diesel fuel used). The form may also require proof of fuel purchases and supporting documents.

An example scenario where this form would be used is when a business owner operates a diesel pickup truck for commercial purposes and wants to claim a refund for the fuels tax paid on the diesel fuel used in the vehicle. By using this form, the owner can apply for a refund and potentially reduce operating costs.

When completing this form, the vehicle owner should ensure accuracy in providing vehicle and fuel usage details, as well as submit all required supporting documents. The DMV may verify the information provided before processing the refund.

No specific additional documents are mentioned for this form. Related forms could include other fuels tax refund applications for different types of vehicles. An alternative could be requesting a credit instead of a refund for the fuels tax paid on future fuel purchases.