Petition for Appointment of Guardian

A Petition for Appointment of Guardian is a legal document that is used to request the appointment of a guardian for a minor or an adult who is unable to manage their own affairs.

IRS Form 4868. Application for Automatic Extension of Time To File U.S. Individual Income Tax Return

Form 4868 is an application for an automatic extension of time to file a U.S. individual income tax return. It can be obtained from the IRS website or from a tax preparer. The form requires the taxpayer's name, address, Social Security number, and estimated tax liability.

IRS Form 433-A. Collection Information Statement for Wage Earners and Self-Employed Individuals

IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, is a form used by individuals who owe taxes to the Internal Revenue Service (IRS) and need to provide detailed information about their financial situation to the IRS.

IRS Form W-4P. Withholding Certificate for Periodic Pension or Annuity Payments

IRS Form W-4P, also known as Withholding Certificate for Periodic Pension or Annuity Payments, is a form used by pension or annuity recipients to inform their payer how much federal income tax should be withheld from their periodic payments.

IRS Form 8824. Like-Kind Exchanges

IRS Form 8824 is an important form used in the United States for reporting like-kind exchanges.

IRS Form 3921

Form 3921 is an IRS tax form used to report the exercise of an incentive stock option (ISO).

IRS Form 8288. U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons

IRS Form 8288 is a U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons. The main purpose of this form is to report and pay any tax owed on the disposition of U.S.

Customs Declaration Form 6059B

The Customs Declaration Form 6059B, also known as the CBP Declaration Form, is a document that travelers entering the United States must complete. It is a required form that provides essential information about the traveler and the items they are bringing into the country.

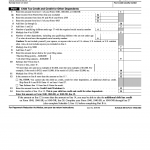

IRS Form 8812

Schedule 8812 (Form 1040) is a tax form used by the Internal Revenue Service (IRS) to calculate the Additional Child Tax Credit (ACTC). It is typically used by individuals who have at least one qualifying child and are claiming the credit.

IRS Form 1095-A. Health Insurance Marketplace Statement

Form 1095-A is an IRS form that is used to report information about an individual's health insurance coverage that was obtained through the Health Insurance Marketplace. The form is typically used by individuals who received subsidies or other assistance through the Marketplace.