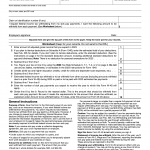

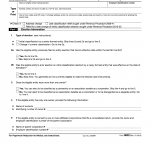

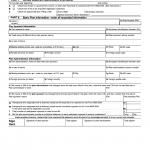

IRS Form 8955-SSA. Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

Form 8955-SSA serves a crucial purpose in meeting the reporting obligations outlined in section 6057(a) of the Internal Revenue Code. This form, designed to replace Schedule SSA (Form 5500), stands as an independent reporting document submitted to the Internal Revenue Service (IRS). It is essential to note that Form 8955-SSA must not be submitted alongside Form 5500 or Form 5500-SF.