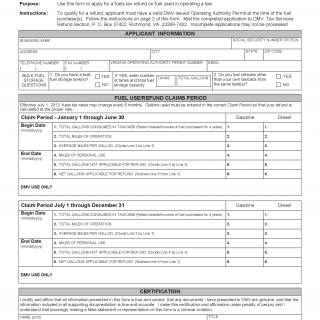

Form TS 221. Fuels Tax Refund Application for Fuel Used in Taxi Operation - Virginia

Form TS 221 - Fuels Tax Refund Application for Fuel Used in Taxi Operation is employed to apply for a fuels tax refund for fuel used in operating a taxi. This form assists taxi operators in claiming a refund on the Virginia Fuels Tax paid for fuel used in their taxi services.

The parties involved include taxi operators, taxi companies, and the Virginia Department of Motor Vehicles. The form consists of sections for fuel usage details, tax payment, and refund request.

Important fields encompass taxi information, fuel usage specifics, tax payment, and refund request amount. Accurate reporting of taxi operations and fuel consumption is crucial for successful refund application.

For example, a taxi company or individual taxi operator who uses fuel for providing taxi services would complete this form to apply for a refund on the Virginia Fuels Tax paid for fuel used in taxi operations.

No direct related forms are mentioned, but an alternative could involve fuel tax refund application forms for other types of commercial transportation services.