SCDMV Form IFTA-3. IFTA Return

SCDMV Form IFTA-3 is used by individuals or businesses who hold an International Fuel Tax Agreement (IFTA) account in South Carolina to report their quarterly fuel use and mileage data to the South Carolina Department of Motor Vehicles (SCDMV).

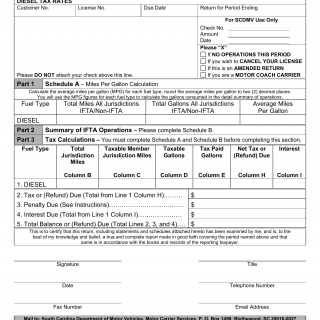

The form consists of several sections to be completed by the filer. These sections include general information about the taxpayer, vehicle information, and a detailed breakdown of fuel consumption and mileage traveled in each jurisdiction.

Important fields on this form include the account holder's name, account number, and contact information. The vehicle information section requires details such as the vehicle identification number (VIN), license plate number, and the total distance traveled in each jurisdiction.

When filling out this form, it is important to accurately report all fuel use and mileage data for each jurisdiction. This may require keeping detailed records of fuel purchases, mileage logs, and other supporting documentation to ensure accurate reporting.

An example of a use case for this form would be a trucking company that holds an IFTA account in South Carolina and needs to report their quarterly fuel use and mileage data. By using this form, the company can provide the necessary information to comply with IFTA regulations and facilitate the calculation and payment of fuel taxes owed to each jurisdiction.

An alternative form that may be related to this one is SCDMV Form IFTA-4. This form is used for IFTA Amended Returns or Claims for Refund. While both forms serve the purpose of reporting fuel use and mileage data, SCDMV Form IFTA-3 is used for regular quarterly reporting, while SCDMV Form IFTA-4 is used for making corrections or claiming refunds for previously reported periods.