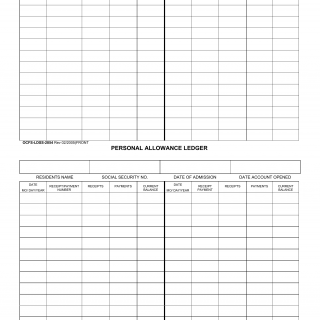

LDSS-2854. Personal Allowance Register

Form Personal Allowance Register is a document used to track and record allowance payments made to employees or other individuals. It is typically used by organizations to ensure accurate and timely payment and tracking of allowances.

The form typically consists of a header section containing identifying information of the organization and the employee, such as name, organization name, address, and contact number, as well as the date of the allowance payment. The body of the form includes the allowance type, amount paid, tax rate, and other relevant information. The form also includes a verification section, which is used to verify the accuracy of the information provided. This section is typically signed by the employee or organization representative.

Important fields in this form include the allowance type, amount paid, tax rate, and verification section. The allowance type is important to ensure that the allowance is being paid for the correct purpose, such as salary, overtime, bonus, or other allowances. The amount paid should be accurate and reflect the amount agreed upon between the employee and the organization. The tax rate should also be accurate and reflect the applicable tax rate for the employee’s jurisdiction. It is also important to ensure that the verification section is signed and dated by the employee or organization representative.

A common scenario where this form would be used is when an organization pays an employee an allowance. In this situation, the organization would complete the form, including the employee’s identifying information, the allowance type, amount paid, and tax rate. The employee or organization representative would then sign and date the form to verify the accuracy of the information provided. It is important to ensure that the form is completed accurately and completely in order to ensure accurate and timely payment of the allowance.

Related forms include the Employee Allowance Payment Form, which is similar to the Personal Allowance Register but is used to track and record employee allowance payments made to other organizations. Additionally, the Income Tax Return Form is an alternative form that is used to report the employee’s income and allowances for tax purposes. Other documents that may be required in order to complete this form include proof of address