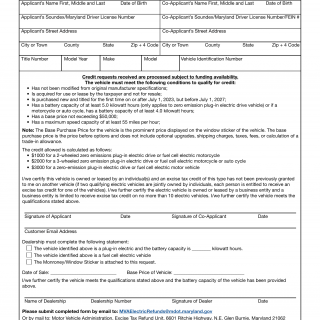

MD MVA Form VR-334 - Excise Tax Credit Request for Plug-in Electric Vehicle

Form VR-334 - Excise Tax Credit Request for Plug-in Electric Vehicle is used to request an excise tax credit for plug-in electric vehicles in Maryland.

This form serves as a request for an excise tax credit that promotes the use of plug-in electric vehicles in Maryland. Individuals who have purchased or leased such vehicles can use this form to apply for a tax credit, encouraging the adoption of environmentally friendly vehicles. For instance, someone who has bought an electric car would use this form to request the applicable tax credit.

The parties involved are owners or lessees of plug-in electric vehicles and the Maryland Motor Vehicle Administration. The form typically consists of sections for providing vehicle and applicant information, details about the electric vehicle, and the specific tax credit request. Accurate completion of this form is important to receive the tax credit and promote the use of electric vehicles.