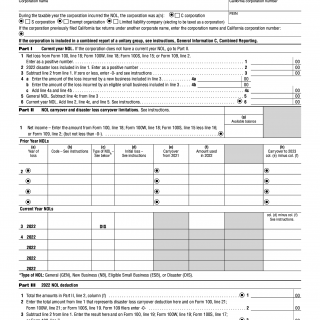

Form FTB-3805Q. Net Operating Loss (NOL) Computation and NOL and Disaster Loss Limitations - Corporations

Form FTB-3805Q is a California Franchise Tax Board form that is used by corporations to compute and report their net operating loss (NOL) and disaster loss limitations for tax purposes. The main purpose of this form is to help corporations calculate their NOL and to determine the amount of NOL that can be carried forward or back to offset taxable income in future years.

The form consists of several parts, including Part I which requires the taxpayer to provide general information about the corporation and its tax year. Part II is used to compute the NOL and includes various adjustments to income, deductions, and credits. Part III is used to calculate the disaster loss limitation, which limits the amount of NOL that can be deducted due to a disaster-related loss.

Important fields on the form include the taxpayer's name, address, federal employer identification number (FEIN), and taxable year. In addition, the taxpayer must provide detailed information about any NOLs and disaster losses incurred during the tax year.

It is important for corporations to carefully review the instructions provided with Form FTB-3805Q and to ensure that all required information is accurately reported. Corporations may need to attach additional documentation to support their NOL and disaster loss calculations.

Some application examples of Form FTB-3805Q include corporations that have experienced significant losses due to natural disasters or other unforeseen events. By computing their NOL and disaster loss limitations, these corporations can potentially reduce their tax liability in future years and improve their financial situation.

Strengths of Form FTB-3805Q include its ability to help corporations accurately calculate their NOL and disaster loss limitations, which can ultimately result in tax savings. Weaknesses may include the complexity of the form and the potential for errors if not completed accurately.

Alternative forms to consider include IRS Form 1045, which is used to apply for a tentative refund due to an NOL carryback, and IRS Form 1139, which is used to apply for a tentative refund due to a net operating loss carryback or an unused general business credit.

Overall, Form FTB-3805Q plays an important role in the future of corporations by helping them accurately report their NOL and potentially reduce their tax liability in future years. The form can be submitted electronically or by mail and is stored by the California Franchise Tax Board for record-keeping purposes.