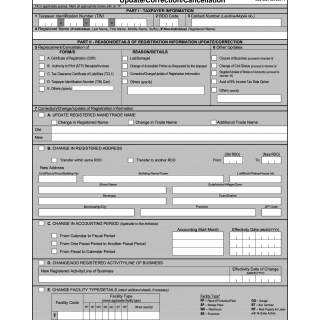

BIR Form 1905. Application for Registration Information Update/Correction/Cancellation

The BIR Form 1905 is an application for Registration Information Update/Correction/Cancellation. This form is used by taxpayers who need to update their details in the Bureau of Internal Revenue (BIR) database. The main purpose of this form is to ensure that the taxpayer's records are accurate and up-to-date, which is important for tax compliance purposes.

The form consists of several parts, including the taxpayer's personal information, the type of registration information to be updated, and the reason for the update. The important fields on this form include the taxpayer's name, Tax Identification Number (TIN), address, contact details, and the specific information to be updated or corrected.

The parties involved in this process are the taxpayer and the BIR. The accuracy of the information provided by the taxpayer is crucial to ensure that the BIR has the correct information on file. Any errors or discrepancies in the taxpayer's records could lead to problems with tax compliance and potential penalties.

When writing this form, the taxpayer will need to provide their updated or corrected information and the reason for the update. Additionally, supporting documents may need to be attached, depending on the type of information being updated. For example, if the taxpayer is updating their name, they may need to provide a copy of their marriage certificate or legal name change document.

Application examples of this form include updating personal information such as a change in address or contact details. It can also be used to correct errors in the taxpayer's records, such as misspelled names or incorrect TINs.

Strengths of this form include its simplicity and ease of use. It is a straightforward form that can be completed quickly and easily. However, weaknesses include the potential for errors or discrepancies if the taxpayer does not provide accurate information.

Alternative forms to the BIR Form 1905 include the BIR Form 2305 (Certificate of Update of Exemption and of Employer's and Employee's Information) which is used for updating employee information and the BIR Form 1604CF (Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes) which is used for reporting withholding taxes on compensation.

Once submitted, the BIR will process the form and update the taxpayer's records accordingly. The accurate recording of information on this form is important for tax compliance purposes. The form is stored in the BIR's database and can be accessed by authorized personnel for future reference.