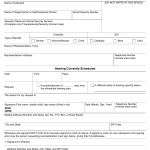

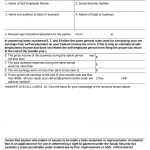

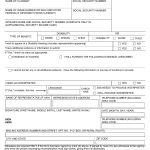

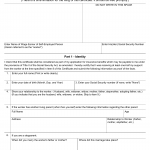

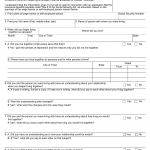

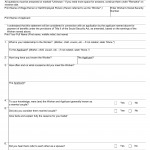

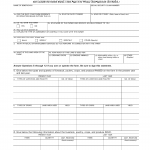

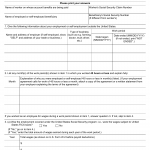

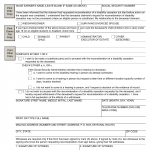

Form SSA-770-U4. Notice Regarding Substitution of Party Upon Death of Claimant Reconsideration of Disability Cessation

Form SSA-770-U4, the Notice Regarding Substitution of Party Upon Death of Claimant - Reconsideration of Disability Cessation, is used to notify the SSA about the substitution of a party when a claimant passes away during the reconsideration of disability cessation process. The primary purpose is to inform the SSA about changes in representation due to the claimant's death.