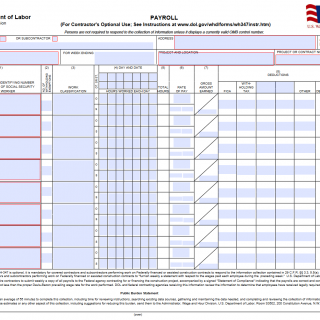

WH-347 DBRA Certified Payroll Form

The WH-347 form is a document used by contractors for the purpose of submitting certified weekly payroll reports to the contracting agency in the United States. This form is used to verify that contractors are paying their employees at the proper prevailing wage rate and that fringe benefits are being paid correctly.

The WH-347 form typically consists of the following parts:

- Contractor and Contract Information - This includes the name and address of the contracting agency as well as the name and address of the contractor and their contract number.

- Project Information - This includes information about the location of the project, start and end dates, and any sub-contractors involved.

- Employee Information - This includes the name, social security number or employee identification number, job classification, hours worked for the week, rate of pay, and any fringe benefits paid to the employee.

- Statement of Compliance - This is a statement signed by the contractor certifying that they have complied with prevailing wage requirements and that the information contained in the report is accurate.

The WH-347 form is drawn up by contractors who are working on federally-funded construction projects and are required by law to submit certified payroll reports to the contracting agency. The parties involved in this process include the contractor, employees, and the contracting agency.

When compiling the WH-347 form, it is important to ensure that all required information is accurately and completely filled out. Failure to do so can result in legal penalties and fines for the contractor, and can also cause delays and complications in the payment process.

As a consultant helping you fill out and submit the WH-347 form, I would ensure that all applicable laws and regulations are followed, and that all required information is provided in a timely and accurate manner. This would minimize the risk of legal problems or payment delays due to incomplete or inaccurate information.

The advantages of the WH-347 form include its ability to ensure that contractors are paying their employees at the proper prevailing wage rate and that fringe benefits are being paid correctly. This can help prevent underpayment of workers and also ensure that contractors are complying with applicable laws and regulations.

However, problems can arise if the form is filled out incorrectly. Inaccurate information can lead to legal problems and can also cause delays in the payment process. Therefore, it is important to ensure that the WH-347 form is accurately and completely filled out to avoid any problems that may arise due to incorrect information.