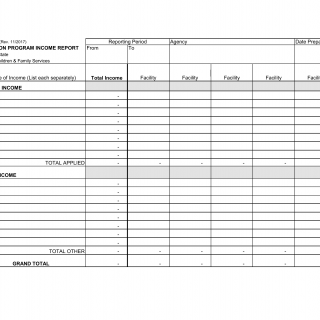

OCFS-2654. Detention Program Income Report

Form OCFS-2654 is a New York State Office of Children and Family Services form used to report income earned from a detention program.

The parties involved with this form are the employer, the employee, the Office of Children and Family Services, and the Department of Taxation and Finance.

This form consists of seven sections. The first section is the employer section, which includes the employer's name, mailing address, and contact information. The second section is the employee section, which includes the employee's name, mailing address, and contact information. The third section is the detention program section, which includes the name of the detention program and the amount of income earned from the program. The fourth section is the employer's signature section, which includes the employer's signature and date. The fifth section is the employee's signature section, which includes the employee's signature and date. The sixth section is the payroll taxes section, which includes the amount of payroll taxes to be withheld. The seventh section is the tax return section, which includes the employer's tax return information.

Important fields in this form include the employer's name, the employee's name, the detention program's name, the amount of income earned, the employer's signature, the employee's signature, the amount of payroll taxes to be withheld, and the employer's tax return information. Specific instructions for completing the form are to provide accurate information, sign the form, and submit it to the Office of Children and Family Services. It is important to accurately complete this form in order to ensure that the employee receives the appropriate amount of income and that the employer is in compliance with state tax laws.

An example scenario of the form's usage would be when an employee is hired to work in a detention program. The employer would complete the form, sign it, and submit it to the Office of Children and Family Services. The benefits of using the form include ensuring that the employee receives the correct amount of income and that the employer is in compliance with state tax laws.

Additional documents that may be required when filling out this form include proof of income, proof of employment, and the employee's tax return information. There are no known related forms or alternatives for similar transactions or purposes.