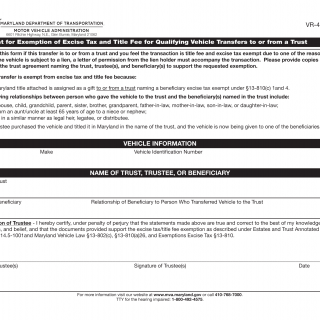

MD MVA Form VR-478 - Request for Exemption of Excise Tax and Title Fee for Qualifying Vehicle Transfers to or from a Trust

Form VR-478 - Request for Exemption of Excise Tax and Title Fee for Qualifying Vehicle Transfers to or from a Trust is used to request an exemption from excise tax and title fees for vehicle transfers involving trusts.

This form is important when a vehicle is transferred to or from a trust, and the parties involved want to claim an exemption from excise tax and title fees. The purpose is to ensure the proper application of tax exemptions in specific trust-related vehicle transfers. An example scenario is when a vehicle is transferred to a revocable trust, and the transferor seeks an exemption from associated fees.

The parties involved include the transferor, transferee, and the Maryland Motor Vehicle Administration. The form typically consists of sections for details of the trust, vehicle information, and a declaration of exemption eligibility. Accurate completion is necessary to ensure the proper application of exemptions.