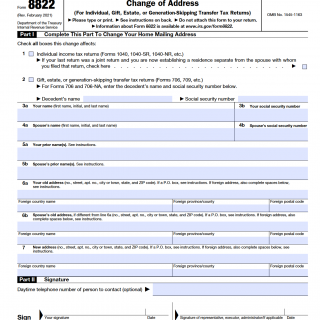

IRS Form 8822. Change of Address

IRS Form 8822, also known as the Change of Address form, is used to notify the Internal Revenue Service (IRS) of a taxpayer or business entity's new address for tax purposes. The form is used to update an individual or entity's records with the IRS and ensure that important tax documents are sent to the correct address.

The form consists of two pages and includes sections to provide the taxpayer's old and new address information, taxpayer identification number (such as a Social Security Number or Employer Identification Number), and signature of the taxpayer or authorized representative.

This form is typically filed by U.S. taxpayers or business entities who have moved to a new address and want to ensure that they receive important tax documents and correspondence from the IRS at their new address. It can also be filed if a taxpayer's name has changed due to marriage, divorce or legal name change.

The advantages of correctly filling out and submitting the IRS Form 8822 include ensuring that the taxpayer receives all important tax documents and correspondence at their correct address, reducing the risk of missing payment deadlines, and avoiding potential issues with the IRS.

Problems that can arise from incorrectly filling out the form include not receiving important tax documents, delays in processing tax returns, potential penalties for missed deadlines, and potential legal issues if a taxpayer's address was not updated in a timely manner.