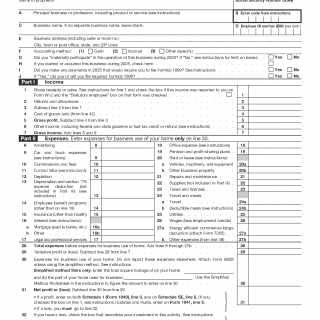

IRS Form 1040 Schedule C

IRS Form 1040 Schedule C is an official schedule used to report income and expenses from a trade or business operated by an individual. It is filed as part of Form 1040 and serves to calculate the net profit or net loss from business activity for inclusion in the individual income tax return.

Purpose of Schedule C

The primary purpose of Schedule C is to provide a standardized framework for reporting business activity conducted by an individual outside of a separate taxable entity. The form separates business income and expenses from other types of income, allowing the Internal Revenue Service to evaluate business results within the individual tax system.

Who Uses Schedule C

Schedule C is used by individuals who carry on a trade or business directly and are required to report that activity with their individual income tax return. This includes sole proprietors, certain statutory employees, and owners of single-member limited liability companies treated as disregarded entities for federal tax purposes.

How Schedule C Functions Within Form 1040

Schedule C is not filed on its own. It is completed as a supporting schedule and submitted together with Form 1040. The form calculates business profit or loss, which is then carried into the main return and may affect additional schedules associated with individual business activity.

Structure of the Form

Schedule C is organized into multiple parts that reflect the flow of business reporting. These parts cover income, expenses, cost of goods sold, and additional supporting information. Together, they produce a single net profit or net loss figure that represents the annual result of the reported business activity.

Official Form and Instructions

This page provides access to the official IRS Schedule C form and the corresponding instructions issued by the Internal Revenue Service. The instructions explain how the form is structured, define key terms used on the schedule, and describe how each section is intended to be completed. The form and the instructions are authoritative sources and are intended to be used together.

Related Explanations

Detailed explanations of how Schedule C is used in practice, how it relates to other schedules, and how different reporting situations are handled are available in the Schedule C notes section at IRS Schedule C Overview.